Dedicated to those who truly believe in Global Local, seeking investment opportunities abroad especially mainland China, Hong Kong, Taiwan and Singapore. 立足大马 放眼世界 见证中国的崛起 捉紧投资大中华的机会!!!

Wednesday, December 26, 2007

Thursday, December 13, 2007

Be Patient, No Hurry !!!

The market has came down after 25 basis pts rate cut in US. The fact is "sell on news is always right" regardless the outcome of the FOMC meeting.

The market has came down after 25 basis pts rate cut in US. The fact is "sell on news is always right" regardless the outcome of the FOMC meeting.Wednesday, December 12, 2007

Monday, December 10, 2007

New listing: CHOLAND-C1, PINGAN-C1, APPLE-C1, EXMOBIL-C1

CHOLAND-C1 issued @ RM0.07; underlying share @ HKD17.30; premium 10.34%

EXMOBIL-C1 issued @ RM0.09; underlying share currently trading around USD89;

APPLE-C1 issued @ RM0.11; underlying share currently trading around USD195;

Friday, December 7, 2007

Time to SELL!

Buy on rumors and sell on news! Whatever FOMC meeting's outcome is to mitigate the problems. Problems are still exist. The only remedy is the time. It needs time to recover from the severe sickness which is SUBPRIME!

Monday, December 3, 2007

Tuesday, November 27, 2007

New listing: CHCOAL-C1, ICBC-C5, PETROCH-C5, SINOPEC-C2

CHINA COAL (1898)

CHINA COAL (1898)CHCOAL-C1 issued @ RM0.07; underlying share @ HKD21.90; premium 15.26%

ICBC (1398)

ICBC-C5 issued @ RM0.06; underlying share @ HKD6.03; premium 21.61%

All four call warrants are anticipated to move to a premium of more than 30% (please refer to the tables for the cw prices). With Dow Jones currently surging up high, tomorrow will be a great day for these new listings. Issued with cheap pricing and low exercise prices, these call warrants are highly suitable for investors to buy and hold.

Monday, November 26, 2007

New listing: BURSA-CH, TM-CG, CCCC-C5, TOYOTA-C1

BURSA (1818)

BURSA-CH issued @ RM0.62; underlying share @ RM13.40; premium 34.18%

TM (4863)

TM-CG issued @ RM0.28; underlying share @ RM10.60; premium 12.26%

CCCC (1800)

CCCC-C5 issued @ RM0.45; underlying share @ HKD21.25; premium 22.43%

TOYOTA (7203)

TOYOTA-C1 issued @ RM0.46; underlying share @ JPY5990.00; premium 14.01%

Friday, November 23, 2007

Time to Bottom Fish !!!!!!

Sunday, November 18, 2007

New listing: KLK-CE, MISC-CD, HSBC-C3, HWL-C3

KLK (2445)

KLK (2445)KLK-CE issued @ RM0.57; underlying share @ RM16.60; premium 7.53%

MISC (3816)

MISC-CD issued @ RM0.28; underlying share @ RM9.70; premium 14.64%

HSBC (0005.HK)

HSBC-C3 issued @ RM0.62; underlying share @ RM136.20; premium 22.72%

HWL (0013.HK)

HWL-C3 issued @ RM0.62; underlying share @ RM88.15; premium 22.69%

Tuesday, November 13, 2007

New listing: CHMOBIL-C6, CHMOLY-C1, GOOGLE-C1

CHINA MOBILE (0941)

CHINA MOBILE (0941)CHMOBIL-C6 @ RM0.14; underlying share @ HKD128.90; premium 45.51%

CHINA MOLYBDENUM (3993)

China Molybdenum Co. Ltd (CMOC) is a leading producer of molybdenum with world-class integrated mining and processing facilities.

Molybdenum, in pure metal form, is silvery white and very hard. Its ability to withstand extreme temperatures make it useful in applications that involve intense heat including aircraft parts, electrical contacts, industrial motors and filaments. Owing to its high corrosion resistance

and weld ability, molybdenum is also used as an alloying agent in stainless steels, tool steels, cast irons and super alloys.

CMOC's primary business operations involve molybdenum mining flotation roasting and smelting and downstream processing. Besides that, the group is also a growing producer of tungsten products.

CHMOLY-C1 @ RM0.10; underlying share @ HKD16.56; premium 48.86%

GOOGLE (GOOG)

GOOGLE-C1 @ RM0.11; underlying share is currently trading around USD655.00; premium 18.90%

With the current high level of premium for the c.warrants above, I doubt the prices would move any much higher. Nevertheless, its cheap pricing might attract traders/investors to buy these warrants. Anyway even ZIJIN-C1 is currently having a 65% premium.

To wrap things upa little, all the 3 CWs could be trading in a range close to their issue prices since the US market is currently on the rise (up >150 points). It would be best to take profit (hopefully there is some), since the market condition is still uncertain.

Monday, November 12, 2007

New listing: PBBANK-CE, YTL-CE, HSI-C3, MTR-C1

Public Bank

PBBANK-CE @ RM0.54; underlying share @ RM10.70; premium 16.45%

YTL

YTL-CE @ RM0.63; underlying share @ RM7.45; premium 17.58%

Hang Seng Index

HSI-C3 @ RM0.728; HSI is currently @ 27665.73; premium 30.56%

MTR Corporation (0066)

MTRC is a leading mass transport service provider in HK with core business engaged in the ownership and operation of the Mass Transit Railway ("MTR"). It is also engaged in property development at locations relating to the railway system.

MTR-C1 @ RM0.475; underlying share @ HKD25.10; premium 25.17%

The market is currently very unstable with the sub-prime issue still lingering around. With the current level of premium on these warrants together with the current market condition, it would be wise to take whatever profit there might be tomorrow. Good luck.

Monday, November 5, 2007

Hang Seng Index dropped most since 9/11

Hong Kong's Hang Seng Index tumbled the most since the Sept. 11, 2001, terrorist attacks after Chinese Premier Wen Jiabao said his government may delay allowing mainland investors to buy Hong Kong stocks.

Hong Kong's Hang Seng Index tumbled the most since the Sept. 11, 2001, terrorist attacks after Chinese Premier Wen Jiabao said his government may delay allowing mainland investors to buy Hong Kong stocks.China Mobile Ltd. had the biggest decline in five years, while China Unicom Ltd. plunged 8.3 percent. PetroChina Co., China's largest oil explorer, dropped the most in almost seven years even as its shares rallied in their first day of trading in Shanghai.

The second straight day of declines halted a 49 percent rally in the Hang Seng that began Aug. 20 when China's currency regulator said mainland investors would be allowed to invest in Hong Kong. Premier Jiabao said on Nov. 3 that the government needed more time to assess the risks to the stability of the city's financial system.

"I expect a significant correction in the Hong Kong market over the next few weeks,'' said Aaron Boesky, who manages $200 million as chief executive officer at Marco Polo Investments Ltd. in Hong Kong.

The Hang Seng Index plunged 1,526.02, or 5 percent, to close at 28,942.32, its steepest decline since September 2001 and the largest fluctuation among markets included in global benchmarks. The Hang Seng China Enterprises Index, which tracks 43 so-called H shares of Chinese companies listed in Hong Kong, lost 6.4 percent to 18,291.20, the biggest decline since May 2004.

source: bloomberg

Sunday, November 4, 2007

New listing: MAYBANK-CF, TENAGA-CG, CHMOBIL-C5, ICBC-C4

MAYBANK

MAYBANKMAYBANK-CF @ RM0.515; underlying share @ RM11.30; premium 13.54%

We set a premium of 20%, the price of the call warrant would be RM0.88 (+36.5 cents / 70.87% gain in price)

TENAGA

TENAGA-CG @ RM0.62; underlying share @ RM9.20; premium 14.57%

We set a premium of 20%, the price of the call warrant would be RM0.87 (+25 cents / 40.32% gain in price)

ICBC-C4 @ RM0.485; underlying share @ HKD6.83; premium 14.13%

We set a premium of 20%, the price of the call warrant would be RM0.66 (+17.5 cents / 36.08% gain in price)

Tuesday, October 30, 2007

Monday, October 29, 2007

China Construction Bank (0939.HK) TP10.10

Buy CHCBC-C1 at 18.5sen and below!

Friday, October 26, 2007

BUY China Life Call Warrant

Based on TP of HK60.88, the ChLife-C4 will be at RM1.06 with zero premium attached.

ChLife is currentlt trading at 51.85 , ChLife-C4 is at 72 sen 11:52am 26 Oct07.

Monday, October 22, 2007

Use your brain, not your feet...

ChMerch-C1 at 19.5 sen fetched 46.1%, HKEX-C4 at 34.5 sen 55.4%, Zijin-C1 at 19.5sen 55% and CHCBC-C1 19 sen is 34.1% premium.

The prices are TOO BULL to pay for.

Pay more attention to CHLife-C4, currently trading at 68sen, 10 to 1, Exe. price at HK36.88. Premium is only 2% ! Expiry date is 23/5/2007. Too good to be true!

But, this ChLife-C4 is issued by CIMB, seems like those CWs issued by CIMB received luke warm respond by the market especially retailers. What's wrong with CIMB issued CW? Any one know why?

Remember to bottom fish if the market continuesly dropping for 3/4 days!

New listing: CHCBC-C1, CHMERCH-C1, HKEX-C4, ZIJIN-C1

Since the issue price of the warrants are cheap and given the bullishness of the HK market, I will set a premium of 20% to estimate the trading price of the CWs tomorrow.

Since the issue price of the warrants are cheap and given the bullishness of the HK market, I will set a premium of 20% to estimate the trading price of the CWs tomorrow.We set a premium of 20%, the price of the call warrant would be RM0.10 (no gain in price)

We set a premium of 20%, the price of the call warrant would be RM0.16 (+5cents / 45% gain in price)

We set a premium of 20%, the price of the call warrant would be RM0.11 (+4cents / 59% gain in price)

Wednesday, October 17, 2007

Post-NCCP phobia

The 17th NCCP was unveiled on 15th October and will last until 21 October.

The 17th NCCP was unveiled on 15th October and will last until 21 October.According to the track record of post-NCCP performances since 1977, the HSI should decline in the first three months. On average, HSI lost 6.7% in the first month after the NCCP, 9.8% in the second month and 8.9% in the third month. Please refer to the table.

Nevertheless, UOB KayHian research expects "the decline to be short-lived and the correction to be shallow", as "the abundant liquidity coming into the market this time could help narrow downside risk."

Thursday, October 11, 2007

RED means STOP!

Share prices closed at yet another record high as strong gains in China financials, coal stocks and oil firms helped the key index break the 29,000 points level. Liquidity inflows due to China's expanded qualified domestic institutional investor (QDII) program and a fresh high on the Shanghai bourse helped H-shares maintain their momentum.

Share prices closed at yet another record high as strong gains in China financials, coal stocks and oil firms helped the key index break the 29,000 points level. Liquidity inflows due to China's expanded qualified domestic institutional investor (QDII) program and a fresh high on the Shanghai bourse helped H-shares maintain their momentum. The Hang Seng index closed up 563.69 points or 1.97% at 29,133.02, off a low of 28,609.68 and just a tad off the new all-time-high of 29,133.76. Turnover was heavy at 178.71 billion HKD. The Hang Seng China Enterprises index closed up 932.13 points or 5.1% at 19,218.05, slightly off a new all-time-high of 19,219.44.

Coal stocks surged and hit new all-time-highs, with China Shenhua Energy outperforming after UBS raised its target price on the stock to HKD101.00 from HKD35.15 citing strong demand for coal. China Shenhua closed up 11.2 HKD or 24.01% at HKD57.85, off an all-time-high of HKD57.95.

Oil stocks were higher after crude prices rose overnight. PetroChina was up 86 cents or 5.9% at HKD15.44, with investors ignoring news that US Investor Warren Buffett's Berkshire Hathaway cut its stake further in China's largest oil producer to 3.1%. CNOOC was up 72 cents or 5.6 pct at 13.58 and Sinopec rose 1.16 HKD or 11. 39% to HKD11.34.

The market has gone crazy. Funds and even retail investors ignored all fundamentals and just kept on buying as if there is no tomorrow. I feel that a major correction is just around the corner and this is definitely not the time for new investments as nearly all stocks are already overbought. Anyone who has just joined the market now should play for the short term and should lock in profits quickly. "I expect the market to cool down a bit next week during (China's) 17th Communist Party Congress as the Chinese government may announce stronger austerity measures to cap growth in housing and stock markets," said Castor Pang, a strategist at Sun Hung Kai Financial group. The market correction is imminent, therefore please buy cautiously!

Monday, October 8, 2007

New listing: ZB-CIMB, ZC-CIMB

1) Black Gold basket CWs; ZC-CIMB (0900ZC)

Comprising ordinary shares of SCOMI (x 1.0), SAPCRES (x 1.0), PETROCHINA (x 1.0), CNOOC (x 1.0), and SINOPEC (x 1.0).

Based on today's closing prices, ZC-CIMB is currently having a premium of 18.50%.

By applying a 20% premium, it is expected to be trading around RM0.355 (+3cents or +9.23% gain in price).

2) 3 Treasures basket CWs; ZB-CIMB (0900ZB)

Comprising ordinary shares of BURSA (x 2.0), HKEX (x 0.5), and SGX (x 1.0).

Based on today's closing prices, ZB-CIMB is currently at 10.37% premium.

A 20% premium will raise the basket cws to RM0.650 (+23cents or +54.76% gain in price).

Please refer to the table above for more details.

Sunday, September 30, 2007

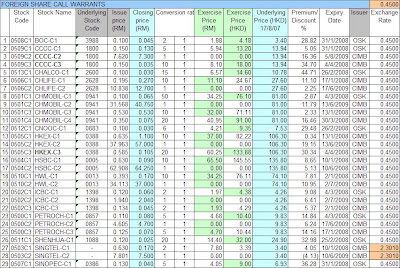

List of HK call warrants

Many of the HK-CWs closed at a discount last Friday as traders and investors disposed of their shares; partly because many do not want to hold any positions over the weekend and also force-selling activities. The Dow Jones industrial index closed slightly lower last Friday at 13,895.63 (-17.31 points). Traders can watch out for the CWs with huge discount, such as CHMOBIL-C1 (1.83% discount), CNOOC-C1 (2.08% discount), & ICBC-C3 (1.87% discount). Nevertheless, do stay cautious as many of the underlying stocks have already risen quite a lot.

Many of the HK-CWs closed at a discount last Friday as traders and investors disposed of their shares; partly because many do not want to hold any positions over the weekend and also force-selling activities. The Dow Jones industrial index closed slightly lower last Friday at 13,895.63 (-17.31 points). Traders can watch out for the CWs with huge discount, such as CHMOBIL-C1 (1.83% discount), CNOOC-C1 (2.08% discount), & ICBC-C3 (1.87% discount). Nevertheless, do stay cautious as many of the underlying stocks have already risen quite a lot.Thursday, September 27, 2007

New listing: CHLIFE-C4, PETROCH-C4

China Life (2628)

CHLIFE-C4 @ RM0.32 ; underlying share @ HKD 43.20 ; premium 2.02%

At a premium of 15%, CW price is RM0.57 (25 cents / 78.0% gain)

CHLIFE-C3 closed at 20 cents today (premium 15.70%), thus CHLIFE-C4 should be trading at around the same premium too.

Petro China (0857)

PETROCH-C4 @ RM0.145 ; underlying share @ HKD14.06 ; discount 6.62%

At a premium of 15%, CW price is RM0.416 (27 cents / 186.58% gain)

It's been a long time since we last saw call warrants hit more than 100% gain on the first day of trading. Even with a 5% premium, PETROCH-C4 can go to 29 cents, a 100.28% gain in price!

Are the glory days of the call warrants coming back?

Wednesday, September 26, 2007

New listing: ANGANG-C1, CHEUNGK-C1, CCCC-C4, CHLIFE-C3

The table above shows prices of the call warrants at different premiums (from 0% to 25%), based on the latest closing prices of the underlying shares.

The table above shows prices of the call warrants at different premiums (from 0% to 25%), based on the latest closing prices of the underlying shares.By referring to past information, we can assume that investors are most likely willing to purchase newly listed CWs at 15% premium on a normal trading day. If the market is extra bullish, a 20% premium wouldn't be much of a problem. Using a premium of 15%, we can roughly guess the prices of the CWs for tomorrow.

Angang Steel (0347)

ANGANG-C1 @ RM0.10 ; premium 11.85%

At a premium of 15%, CW price is RM0.113 (13.18% gain)

Note: Angang Steel's H-share is still trading around 30% discount to its A-shares.

Cheung Kong (0001)

CHEUNGK-C1 @ RM0.11 ; premium 9.94%

At a premium of 15%, CW price = RM0.147 (33.93% gain)

Note: The recent rate cut in Hong Kong has benefited property stocks.

China Communications Construction (1800)

CCCC-C4 @ RM0.11 ; premium 19.14%

At a premium of 15%, CW price = RM0.088 (20.36% loss)

Note: CCCC's share price has not moved much for the past 2 weeks, causing its CW to have a higher premium. Nonetheless, I reckon CCCC-C4 will still be able to stay on the green side tomorrow.

China Life Insurance (2628)

CHLIFE-C3 @ RM0.11 ; premium 5.44%

At a premium of 15%, CW price = RM0.169 (53.69% gain)

Note: China Life's share price has just started to move, and is heading to 45HKD.

Wednesday, September 19, 2007

Fed reduced interest-rate; HSI closed at record high

The benchmark Hang Seng Index closed up 977.79 points or 4%at 25, 554.64, after hitting a fresh intraday high of 25,648.44. Breadth was positive as gainers outpaced decliners 572 to 409 while 151 stocks were unchanged. Volume traded reached 18.17 billion share worth 131.81 billion HK dollars.

Market heavyweight CNOOC ended at a record high, up 1.32 dollars or 12.4% at HKD11.98. CNOOC, the listed arm of the mainland's largest offshore oil producer, China National Offshore Oil Corp, surged after oil prices breached 82 US dollars per barrel in after-market trading today. Brokerage house Goldman Sachs has a "buy" rating on CNOOC as it expects the company to benefit more than its peers from the higher oil prices. Its call warrant CNOOC-C1 surged a 6 cents (44.44%) to close at an intraday high of 19.5 cents.

Monday, September 17, 2007

China raised lending rate... again..

China raised its benchmark one-year lending rate by 27 basis points to 7. 29 percent, the highest level in nine years, in a continuing effort to cool the economy and curb inflation. It is the fifth time this year that the Chinese authorities have increased rates. The annual rate of inflation in the mainland accelerated to 6.5 percent in August, the highest since December 1996, as the economy expanded at an annual rate of 11.9 percent in the second quarter, the fastest pace in 12 years. Aside from raising rates, analysts also expect China to increase the amount of reserves that banks should deposit with the central bank to cut bank lending and ease consumer spending.

China raised its benchmark one-year lending rate by 27 basis points to 7. 29 percent, the highest level in nine years, in a continuing effort to cool the economy and curb inflation. It is the fifth time this year that the Chinese authorities have increased rates. The annual rate of inflation in the mainland accelerated to 6.5 percent in August, the highest since December 1996, as the economy expanded at an annual rate of 11.9 percent in the second quarter, the fastest pace in 12 years. Aside from raising rates, analysts also expect China to increase the amount of reserves that banks should deposit with the central bank to cut bank lending and ease consumer spending.

Sunday, September 16, 2007

The 2 Giant Chinese energy companies: China ShenHua Energy & CNOOC

The China Securities Regulatory Commission (CSRC) said it will review China Shenhua Energy's plan for an initial public offering on the Shanghai Stock Exchange. According to a draft prospectus, Shenhua Energy, China's largest coal producer, will issue up to 1.8 bln A-shares for listing.

Quoted from the Forbes' Fabulous 50: "China is burning coal faster than its largest miner can pull it out of the ground. So China Shenhua is looking for more, both at home and abroad. Plans to raise $7 billion with a new listing in Shanghai's roaring market (it listed in Hong Kong 2 years ago), even though it has plenty of cash. Will use the proceeds to expand its 21 domestic mines, to acquire more mines, add more power plants and beef up its railroad and harbor infrastructure. Chairman Chen Biting aims to make China Shenhua, now number 2, the world's largest coal miner. Is 80% owned by Shenhua Group, a government entity."

SHENHUA-C1 surged 4.5 cents (+25.71%) to close at 22 cents (premium 3.14%) with an intra-day high of 23 cents last Friday.

With the oil price touching a new high, the next counter to look out for is the China National Offshore Oil Corporation Ltd. (CNOOC) and its call warrant, CNOOC-C1.

Quoted from the Forbes' Fabulous 50: "China's buccaneering offshore oil company goes where few Western giants dare in search of resources. Signed an exploration contract in war-torn Somalia in May and is reportedly negotiating in Iran. The shares, listed in Hong Kong, have risen 22% in the last 12 months, but net income has been growing at 32% on average over the last 5 years. Came to embody Western fears of Asian state-owned companies buying up corporate America and Europe after its bid for Unocal was blocked by the US government in 2005. CNOOC is 66% owned by government entities, but independent board members are in place to speak for international shareholders."

CNOOC added 20 cents to closed at HKD 10.34 last Friday. Meanwhile its call warrant, CNOOC-C1 closed at 12.5 cents (+1 cent / +8.7%) last Friday, and currently having a premium of 6.62%.

Wednesday, September 12, 2007

H-shares trading at discount to A-shares; the CWs to look out for are...

At present, only call warrants of these four companies are being listed on bursa (CHALCO, CHINA LIFE, ICBC, and SINOPEC).

At present, only call warrants of these four companies are being listed on bursa (CHALCO, CHINA LIFE, ICBC, and SINOPEC). By allowing investors from mainland China to invest overseas, H-shares in Hong Kong which are trading at discount to their A-shares counterparts in Shanghai/ShenZhen would definitely be at the top of the list. Most likely, these H-shares prices will rise and A-shares prices will fall as investors would opt for H-shares which are much more cheaper.

The orange column shows the price of the H-share if it was to rise to at least half the level of the A-share price. And from there, we can project the expected price for its call warrant. Please refer to the table above.

Monday, September 10, 2007

HKEX's price skyrocketed!

"The main reason you are acquiring a stake is if it's a very good buy. If (the market's) turnover continues to grow the way that it has over the last few months the exchange will be worth more than the price that the government paid," said Tony Espina, chairman of Hong Kong Stockbrokers Association.

The announcement was followed by reports that Hong Kong is seeking permission from China for the city's investors to trade yuan-denominated A shares. ""Hong Kong investors might eventually be able to trade the A-shares. This could happen as the Hong Kong and mainland markets are getting more interactive with each other,"" the South China Morning Post said Monday. The paper was citing Secretary for Financial Services and the Treasury Bureau Chan Ka-keung.

Sunday, September 9, 2007

Fed to cut interest rate

The central bank should also focus on addressing the root of the problem - excess liquidity in the economy, Forbes said at lunch hosted by the Singapore Press Club.

Forbes said the Fed should cut the interest rate, now at 5.25 percent, by 100 basis points when it meets September 18 and make it clear "that while they're going to solve the short-term crisis, they will, over the next year or so, start to mop up the excess liquidity.

"Removing excess liquidity - the Federal Reserve selling bonds from its portfolio and withdrawing funds from the market - that is tightening which the Fed has not done," he said.

Economists increasingly believe the Fed will cut the rate by at least one-quarter percentage point at the September meeting.

The Fed has not lowered the rate in four years, but pressure has been building on it to do so to help ease credit conditions. Lower rates would reduce borrowing costs for everyone from potential homeowners to companies looking to finance activities and purchases.

China to raise reserve requirement ratio

It is the seventh time this year the Chinese government has opted to raise the reserve requirement ratio to curb excess liquidity.

The central bank said the move was aimed at "strengthening liquidity management in the banking system and checking excessive money and credit growth".

PBOC statistics show that China's foreign exchange reserves reached US$1.33 trillion at the end of June, up 41.6 percent over the same period last year.

A total of US$266.3 billion was added to the country's foreign exchange reserves in the first half of 2007, US$144 billion more than a year earlier.

"8,530-TEU", First China-made Container Ship

The first 8,530-TEU container ship, of which China owns the full intellectual property rights, had been delivered to China Shipping Container Lines Co. Ltd. (Shanghai) and left for its maiden voyage to the United States on Sunday.

It has made China the fourth country in the world, after the Republic of Korea, Japan and Denmark that is able to design and build such giant container ships, said experts.

The ship, named "New Asia", is the first of five container ships of the same type to be designed and built by Hudong-Zhonghua Shipbuilding (Group) Co. Ltd. for the China Shipping Container Lines Co., Ltd.

The 101,000-dwt container ship, 335 meters long and 42.8 meters wide, can sail at a speed of 25 knots an hour.

The Shanghai-based shipbuilding company spent six years to build the ship, the largest container ship independently designed and built by China. It is one of the mainstream type of container ships in the world.

So far the company has confirmed nine orders for its 8,530-TEU container ships, including four for the Greek Costamare Shipping Co.

Tuesday, September 4, 2007

Property industry to remain hot next 10 years

Due to the wide demand-supply gap in the property market in China, the property industry in the country is expected to maintain a rapid growth in the next ten years.

According to Yang Shen, former Vice Minister of Construction, total floor space of houses had increased by 8.86 billion sq m in 1980 – 2006. The average floor space of houses per capita in China is larger than the figure in many other countries.

In the past decade, the property industry has been soaring continuously at an average annual growth of 14%, contributing to 4.5% of China’s GDP. It is estimated that the growth of the property industry will take up 8% of the country ‘s GDP by 2010.

With nuclear family taking the place of extended family in China, housing demand has become stronger and stronger in the market.

In the next 10 years, commercial houses with the total floor space of 9.9 billion sq m will be needed. That is to say, the property industry must manage to keep an annual growth of 13.2%. However, taking China’s shortage of farmland into consideration, it will be very hard for the property industry to achieve it.

Nevertheless, the shortage of land might also present a chance of rapid growth of business value of the property industry.

ARJ21... Time to fly

China's first self-developed regional aircraft ARJ21 completed the specific design and started manufacturing in April 2006 by China Aviation Industry Corporation I (AVIC I)

China's first self-developed regional aircraft ARJ21 completed the specific design and started manufacturing in April 2006 by China Aviation Industry Corporation I (AVIC I) AVIC I and the Lao Airlines signed a Memorandum of Understanding of two ARJ21 jets, which marked a milestone for the exportation of China self-made aircraft.

The picture shows the cabin section of ARJ21 aircraft which attracted many visitors at the Asian Aerospace International Expo and Congress 2007 currently held in Hong Kong.

Wednesday, August 22, 2007

China's immunity from global turmoil

BEIJING (XFN-ASIA) - China's bid to tighten liquidity while most central banks worldwide are battling to boost cash flows underlines the Asian giant's status as largely immune from the troubles afflicting global markets. The financial insulation, highlighted in a decision to raise interest rates again, is an arrangement of China's own making, as it combines a not fully convertible currency with limited access to the capital markets. ""Fundamentally speaking, the impact the global economy has on China is much, much smaller than on other Asian economies,"" said Ma Jun, a Hong Kong-based economist with Deutsche Bank. Worries about problems in the US mortgage market have caused liquidity to dry up in money markets as private banks withhold funds, prompting US and other central banks to offer extra cash. China is doing the opposite, sucking up as much cash as possible in an only partly successful attempt to prevent it flooding into stocks and property. ""China's central bank is not concerned about the global financial market havoc creeping into the domestic market,"" said Stephen Green, a Shanghai-based economist with Standard Chartered. ""China is still a different universe it seems when it comes to liquidity and growth momentum."" China's central bank raised the benchmark lending rate by 0.18 percentage point to 7.02 pct Tuesday, while the deposit rate was hiked by 0.27 percentage point to 3.60 pct. This was the latest chapter in China's prolonged struggle with excess liquidity, boosted directly by foreign fund inflows under the current exchange rate regime. ""The high level of liquidity is mainly from our large trade surplus plus incoming foreign direct investment,"" said Feng Yuming, a Shanghai-based economist with Orient Securities. ""In addition, there's a great deal of hot money, although it's tough to estimate exactly how much."" The surprise interest rate hike, which is the fourth this year, suggested a more hawkish central bank than many had expected. It also served as a message to local markets about the continued independence of Chinese economic policy-making. ""It's also a signal to the domestic market: Even at a time of a liquidity crunch overseas, China will not change its policy of tightening,"" said Sun Lijian, an economist at Shanghai's Fudan University. But it will not be without risks, especially given the fact that it takes place at the same time as the United States is lowering interest rates. ""It will strengthen the pressure for the Chinese currency to rise, and even more money will flow into China,"" said Han Zhiguo of Beijing Banghe Fortune Research. ""This, in turn, will greatly boost liquidity and heighten inflationary pressures,"" he said. It would seem as a never-ending story, as the policy response might be more rate hikes, which in turn, would encourage fund inflows, and so on. Little by little, however, China is opening up for greater integration with overseas financial markets. This is reflected in a move this week to allow one bank branch in north China's Tianjin city to offer direct investment in Hong Kong stocks. It could lead to 40 bln hkd flowing to Hong Kong stocks in the coming 12 months, according to Deutsche Bank's Ma. ""But it will be another three to five years before China is heading towards full convertibility, and only then will it be possible to say that it has genuinely linked up with global financial markets,"" he said.

China to maintain strong despite US....

BEIJING (XFN-ASIA) - A potential US slowdown is likely to reduce overheating pressure in China rather than have any significant negative impact on the Chinese economy, Goldman Sachs said. China's continued robust growth also proves that it can decouple from an external slowdown, the brokerage said in a note to clients. While US economic growth in the first half slowed to 1.5-1.8 pct, compared with 3.2-3.3 pct a year earlier, China's economy continued to power ahead, expanding 11.5 pct in the first six months of this year. In the US, significant downward pressure could be exerted on consumer spending because of the US subprime crisis, which has raised the risks of a sharper correction in its housing market, Goldman noted. This would affect China's exports, but as this sector is already showing signs of overheating, a slowdown in demand would help alleviate pressure, it said. ""A slowdown in external demand, led by a weakening US, would reduce the overheating pressures in China, and thereby reduce the risks of more aggressive policy tightening,"" the note said. Manufacturers of consumer-related products, such as textiles, apparel, footwear and consumer electronics are likely to be the most adversely affected, Goldman Sachs said. Slower export demand would also leave more room for China's domestic demand to grow, it added. ""A slowdown in the US and elsewhere would potentially help reduce inflationary pressures in China and encourage policymakers to place more emphasis on the need to preserve domestic demand,"" it said. Conversely, if softening of external demand remains muted, the need for China to rein in growth will persist, Goldman Sachs added. The brokerage has an above-consensus GDP growth forecast for China for this year at 12.3 pct. For 2008, Goldman Sachs sees China's economic growth at 10.9 pct. ""Unless the US economy dips into recession, China is likely to be able to maintain its growth rate at 10 pct or above,"" it said.

News Provided by XFNA

Tuesday, August 21, 2007

China raises interest rates 4th time in 2007 to curb inflation

The one-year deposit rate will increase 27 basis points to 3.60 percent, while one-year lending rate will rise by 18 basis points to 7.02 percent, effective on Wednesday, the People's Bank of China said in a statement on its website.

The increase is aimed at better steering bank credit and stabilizing inflation expectation, according to the statement.

The timing is somewhat of a surprise as the central bank usually announces interest rate changes during the weekend in the past. However, the latest hike is not totally unexpected given mounting concerns about overheating economy and accelerating inflation.

China's gross domestic product grew 11.9 percent in the second quarter this year, the fastest recorded in a decade.

In July, the trade surplus rose 67 percent from a year earlier to $24.4 billion, the second-highest monthly total, and the money supply climbed 18.5 percent, the biggest increase in more than a year.

Fixed-asset investment in urban areas increased 26.6 percent in the first seven months from a year earlier, close to the 26.7 expansion in the first half.

The Consumer Price Index, a barometer of inflation, jumped by a 10-year-high 5.6 percent in July, well above the official target of 3.0 percent.

The inflation rate is also higher than the deposit rate, indicating a loss of purchasing power if people put their money into banks.

The low interest rate policy has somewhat encouraged an exodus of bank savings to the country's skyrocketing stock market, which has soared more than 80 percent so far this year on top of a 130 percent rally in 2006.

(source: chinadaily.com.cn)

Individuals Allowed to Buy Overseas Shares

Investors can use their foreign exchange or purchase foreign currency to open an account with Bank of China's Tianjin branch or Bank of China International Securities in Hong Kong, according to a statement on the State Administration of Foreign Exchange (SAFE) website yesterday.

The investment amount will not be subject to the annual limit of US$50,000 for an individual to purchase foreign exchange, as per earlier rules.

"This is part of the process of China's capital account reform," Chen Jijun, analyst with Beijing-based CITIC Securities, told China Daily. "It will help ease liquidity pressure in the country as foreign exchange reserves pile up rapidly," Chen said.

Stephen Green, senior economist with Standard Chartered Bank (China), described it as "a historic move in China's capital account opening".

SAFE said in the statement: "This is an important measure to widen the channels for foreign exchange outflows and promote basic balance in international payments."

Individuals were earlier allowed to invest overseas indirectly through banks, brokerages, insurers and fund managers through the qualified domestic institutional investors (QDII) scheme.

Analysts said the Hong Kong market will be the first to benefit as many mainlanders are likely to buy stocks of mainland companies listed there.

"The policy will surely be welcomed by Hong Kong investors, because mainland investors' participation will help boost confidence as well as market sentiment," said Paul Lee, banking and insurance analyst at Hong Kong-based Taifook Securities.

Lee said the mainland will benefit too, as capital diverted from the A-share market will help "prevent over-heating" and "relieve pressure for the yuan to rise".

(Source: China Daily August 21, 2007)

Sunday, August 19, 2007

List of foreign share call warrants

These CWs with low premiums are worth looking at:

These CWs with low premiums are worth looking at:1) CCCC-C1 RM0.13, underlying share price HKD13.94, premium 5.05%

2) CHMOBIL-C1 RM0.065, underlying share price HKD81.00, premium 2.87%

3) HKEX-C1 RM1.10, underlying share price HKD106.30, premium 0.34%

4) ICBC-C3 RM0.045, underlying share price HKD4.26, premium 5.37%

Thursday, August 9, 2007

List of HK call warrants sorted by premium

Here is an updated list of Hong Kong call warrants sorted from the lowest premium to the highest. As you can see from the list, CCCC-C1 is having the lowest premium of 0.27% which is nearly at par with its underlying share's value. The lower the premium, the better (or cheaper) the CW is. CWs with longer expiry period usually have a higher premium compared to the ones which are close to expiry (This is also referred to as the time value).

Here is an updated list of Hong Kong call warrants sorted from the lowest premium to the highest. As you can see from the list, CCCC-C1 is having the lowest premium of 0.27% which is nearly at par with its underlying share's value. The lower the premium, the better (or cheaper) the CW is. CWs with longer expiry period usually have a higher premium compared to the ones which are close to expiry (This is also referred to as the time value).The orange column shows the theoretical price of the underlying share using current CW price at zero percent premium.

CCCC-C1 with the lowest premium (0.27%) only needs its underlying share price to move up by 4 cents (15.62 - 15.58) to be at par value.

On the other hand, CCCC-C3 which is having the highest premium (24.93%) would need a 3.88 HKD (19.46 - 15.58) increase on CCCC's share price.

At current market condition, a premium of 5% to 10% would be considered fair.

The average premium of all the CWs is 8.58%. This can be used as the benchmark.

Greater China Stockmarket Summary(09/08/07)

HONG KONG

Share prices closed lower as caution re-emerged in late trade following news that French bank BNP Paribas and a US-German joint venture financial institution have been caught up in problems in the US subprime mortgage market. Stocks had advanced significantly, but trading changed course when the news about BNP hit the market, wiping out the day's gains. Some hedge funds reduced their portfolios in Hong Kong to meet possible redemption demands, while other investors locked in profit from recent gains amid fears of more volatility in the global equity markets. The Hang Seng index closed down 97.31 points or 0.43 pct at 22,439.36.

CHINA

China closed higher, driving the composite index to another record for the fifth straight trading day(tak boleh tahan man!), as investors continued to build positions in financial stocks. Steelmakers rebounded from yesterday's weakness as investors were also upbeat about the sector on prospects of industry consolidation and after Wuhan Iron and Steel reported a 171 pct rise in firsthalf net profit. The benchmark Shanghai Composite Index, which covers both A- and B-shares listed on the Shanghai Stock Exchange, closed up 90.93 points or 1.95 pct at a record 4,754.10. The Shanghai A-share Index was up 95. 61 points or 1.95 pct at 4,989.19 and the Shenzhen A-share Index was up 21.21 points or 1.53 pct at 1,411.23. China B-shares closed higher, led by machinery and property stocks following strong gains in their A-share peers. The Shanghai B-share Index was up 4.57 points or 1.45 pct at 320.41 and the Shenzhen B-share Index up 7.25 points or 0.92 pct at 792.12.

Wednesday, August 8, 2007

New listing: PBBANK-CD, TENAGA-CF, CCCC-C2, CCCC-C3, HKEX-C3

With Public Bank's share price closing at RM9.70, PBBANK-CD is currently having a premium of 13.40%. Tenaga which closed at RM10.90, would give its cw TENAGA-CF a premium of 14.68%. Since the market has been quite weak lately, a possible gain of one or two cents would do good.

China Communication Construction Corporation (1800) closed at HKD15.52;

China Communication Construction Corporation (1800) closed at HKD15.52;CCCC-C2 ---> 11.08% premium.

CCCC-C3 ---> 37.85% premium.

Hong Kong Exchange (0388) closed at HKD125.40;

HKEX-C3 ---> 27.87% premium.

CCCC-C3 and HKEX-C3 are both at extremely high premiums. At the current CW prices, the underlying shares (CCCC and HKEX) should trade above HKD 21.40 and HKD160.30, respectively. Well, that's a long way to go.

Since call warrants have limited life span, it may not wise to hold them at this level.

Both CWs will be traded on the negative side tomorrow.

Time to cover some losses:

For those who have subscribed for CCCC-C3, you can dispose the C3's and swap to C1's.

At present, CCCC-C1 is only having a premium of 1.09%. And if the underlying share price was to move up 5% (+78 cents) from HKD15.52 to HKD16.30, its CW should be valued at RM0.275 (more than 24% gain).

Another CW that is worth taking a look is ICBC-C3, which is currently at 2.58% premium.

A 5% increase (+24 cents) on the underlying share price from HKD4.72 to HKD4.96 can lift the CW's price to RM0.13 (+24% gain).

China Mobil "A" rating affirmed.

- BEIJING (XFN-ASIA) - Fitch Ratings maintained its long-term foreign currency issuer default rating on China Mobile Ltd at ""A"", with the outlook ""stable."" The ratings agency said the rating action reflects the company's ""strong operating performance and solid financial profile."" Fitch noted that China Mobile has consistently generated positive free cash flow, enabling it to maintain a net cash position with ""robust"" financial ratios. It also said China Mobile maintains a dominant market position in the country's mobile sector, despite intense competition, and that the company has registered strong subscriber growth while increasing its market share to over 65 pct. Compared to rival China Unicom, the company registers higher minutes of usage and average revenue per user. The rating also reflects the strong growth potential for China's mobile telecom sector, where penetration is still relatively low at around 38 pct, Fitch said. At the close of today's trade in Hong Kong where it is listed, China Mobile Ltd was up 3.15 hkd, or 3.671 pct, at 88.95 hkd.