Rate hike reflects China's immunity from global turmoi 2007-8-22

BEIJING (XFN-ASIA) - China's bid to tighten liquidity while most central banks worldwide are battling to boost cash flows underlines the Asian giant's status as largely immune from the troubles afflicting global markets. The financial insulation, highlighted in a decision to raise interest rates again, is an arrangement of China's own making, as it combines a not fully convertible currency with limited access to the capital markets. ""Fundamentally speaking, the impact the global economy has on China is much, much smaller than on other Asian economies,"" said Ma Jun, a Hong Kong-based economist with Deutsche Bank. Worries about problems in the US mortgage market have caused liquidity to dry up in money markets as private banks withhold funds, prompting US and other central banks to offer extra cash. China is doing the opposite, sucking up as much cash as possible in an only partly successful attempt to prevent it flooding into stocks and property. ""China's central bank is not concerned about the global financial market havoc creeping into the domestic market,"" said Stephen Green, a Shanghai-based economist with Standard Chartered. ""China is still a different universe it seems when it comes to liquidity and growth momentum."" China's central bank raised the benchmark lending rate by 0.18 percentage point to 7.02 pct Tuesday, while the deposit rate was hiked by 0.27 percentage point to 3.60 pct. This was the latest chapter in China's prolonged struggle with excess liquidity, boosted directly by foreign fund inflows under the current exchange rate regime. ""The high level of liquidity is mainly from our large trade surplus plus incoming foreign direct investment,"" said Feng Yuming, a Shanghai-based economist with Orient Securities. ""In addition, there's a great deal of hot money, although it's tough to estimate exactly how much."" The surprise interest rate hike, which is the fourth this year, suggested a more hawkish central bank than many had expected. It also served as a message to local markets about the continued independence of Chinese economic policy-making. ""It's also a signal to the domestic market: Even at a time of a liquidity crunch overseas, China will not change its policy of tightening,"" said Sun Lijian, an economist at Shanghai's Fudan University. But it will not be without risks, especially given the fact that it takes place at the same time as the United States is lowering interest rates. ""It will strengthen the pressure for the Chinese currency to rise, and even more money will flow into China,"" said Han Zhiguo of Beijing Banghe Fortune Research. ""This, in turn, will greatly boost liquidity and heighten inflationary pressures,"" he said. It would seem as a never-ending story, as the policy response might be more rate hikes, which in turn, would encourage fund inflows, and so on. Little by little, however, China is opening up for greater integration with overseas financial markets. This is reflected in a move this week to allow one bank branch in north China's Tianjin city to offer direct investment in Hong Kong stocks. It could lead to 40 bln hkd flowing to Hong Kong stocks in the coming 12 months, according to Deutsche Bank's Ma. ""But it will be another three to five years before China is heading towards full convertibility, and only then will it be possible to say that it has genuinely linked up with global financial markets,"" he said.

Dedicated to those who truly believe in Global Local, seeking investment opportunities abroad especially mainland China, Hong Kong, Taiwan and Singapore. 立足大马 放眼世界 见证中国的崛起 捉紧投资大中华的机会!!!

Wednesday, August 22, 2007

China to maintain strong despite US....

China to maintain strong growth despite US subprime woes - Goldman Sachs

BEIJING (XFN-ASIA) - A potential US slowdown is likely to reduce overheating pressure in China rather than have any significant negative impact on the Chinese economy, Goldman Sachs said. China's continued robust growth also proves that it can decouple from an external slowdown, the brokerage said in a note to clients. While US economic growth in the first half slowed to 1.5-1.8 pct, compared with 3.2-3.3 pct a year earlier, China's economy continued to power ahead, expanding 11.5 pct in the first six months of this year. In the US, significant downward pressure could be exerted on consumer spending because of the US subprime crisis, which has raised the risks of a sharper correction in its housing market, Goldman noted. This would affect China's exports, but as this sector is already showing signs of overheating, a slowdown in demand would help alleviate pressure, it said. ""A slowdown in external demand, led by a weakening US, would reduce the overheating pressures in China, and thereby reduce the risks of more aggressive policy tightening,"" the note said. Manufacturers of consumer-related products, such as textiles, apparel, footwear and consumer electronics are likely to be the most adversely affected, Goldman Sachs said. Slower export demand would also leave more room for China's domestic demand to grow, it added. ""A slowdown in the US and elsewhere would potentially help reduce inflationary pressures in China and encourage policymakers to place more emphasis on the need to preserve domestic demand,"" it said. Conversely, if softening of external demand remains muted, the need for China to rein in growth will persist, Goldman Sachs added. The brokerage has an above-consensus GDP growth forecast for China for this year at 12.3 pct. For 2008, Goldman Sachs sees China's economic growth at 10.9 pct. ""Unless the US economy dips into recession, China is likely to be able to maintain its growth rate at 10 pct or above,"" it said.

News Provided by XFNA

BEIJING (XFN-ASIA) - A potential US slowdown is likely to reduce overheating pressure in China rather than have any significant negative impact on the Chinese economy, Goldman Sachs said. China's continued robust growth also proves that it can decouple from an external slowdown, the brokerage said in a note to clients. While US economic growth in the first half slowed to 1.5-1.8 pct, compared with 3.2-3.3 pct a year earlier, China's economy continued to power ahead, expanding 11.5 pct in the first six months of this year. In the US, significant downward pressure could be exerted on consumer spending because of the US subprime crisis, which has raised the risks of a sharper correction in its housing market, Goldman noted. This would affect China's exports, but as this sector is already showing signs of overheating, a slowdown in demand would help alleviate pressure, it said. ""A slowdown in external demand, led by a weakening US, would reduce the overheating pressures in China, and thereby reduce the risks of more aggressive policy tightening,"" the note said. Manufacturers of consumer-related products, such as textiles, apparel, footwear and consumer electronics are likely to be the most adversely affected, Goldman Sachs said. Slower export demand would also leave more room for China's domestic demand to grow, it added. ""A slowdown in the US and elsewhere would potentially help reduce inflationary pressures in China and encourage policymakers to place more emphasis on the need to preserve domestic demand,"" it said. Conversely, if softening of external demand remains muted, the need for China to rein in growth will persist, Goldman Sachs added. The brokerage has an above-consensus GDP growth forecast for China for this year at 12.3 pct. For 2008, Goldman Sachs sees China's economic growth at 10.9 pct. ""Unless the US economy dips into recession, China is likely to be able to maintain its growth rate at 10 pct or above,"" it said.

News Provided by XFNA

Tuesday, August 21, 2007

China raises interest rates 4th time in 2007 to curb inflation

China's central bank raised the benchmark interest rates on Tuesday for the fourth time this year in an effort to prevent the economy from overheating and curb accelerating inflation.

The one-year deposit rate will increase 27 basis points to 3.60 percent, while one-year lending rate will rise by 18 basis points to 7.02 percent, effective on Wednesday, the People's Bank of China said in a statement on its website.

The increase is aimed at better steering bank credit and stabilizing inflation expectation, according to the statement.

The timing is somewhat of a surprise as the central bank usually announces interest rate changes during the weekend in the past. However, the latest hike is not totally unexpected given mounting concerns about overheating economy and accelerating inflation.

China's gross domestic product grew 11.9 percent in the second quarter this year, the fastest recorded in a decade.

In July, the trade surplus rose 67 percent from a year earlier to $24.4 billion, the second-highest monthly total, and the money supply climbed 18.5 percent, the biggest increase in more than a year.

Fixed-asset investment in urban areas increased 26.6 percent in the first seven months from a year earlier, close to the 26.7 expansion in the first half.

The Consumer Price Index, a barometer of inflation, jumped by a 10-year-high 5.6 percent in July, well above the official target of 3.0 percent.

The inflation rate is also higher than the deposit rate, indicating a loss of purchasing power if people put their money into banks.

The low interest rate policy has somewhat encouraged an exodus of bank savings to the country's skyrocketing stock market, which has soared more than 80 percent so far this year on top of a 130 percent rally in 2006.

(source: chinadaily.com.cn)

The one-year deposit rate will increase 27 basis points to 3.60 percent, while one-year lending rate will rise by 18 basis points to 7.02 percent, effective on Wednesday, the People's Bank of China said in a statement on its website.

The increase is aimed at better steering bank credit and stabilizing inflation expectation, according to the statement.

The timing is somewhat of a surprise as the central bank usually announces interest rate changes during the weekend in the past. However, the latest hike is not totally unexpected given mounting concerns about overheating economy and accelerating inflation.

China's gross domestic product grew 11.9 percent in the second quarter this year, the fastest recorded in a decade.

In July, the trade surplus rose 67 percent from a year earlier to $24.4 billion, the second-highest monthly total, and the money supply climbed 18.5 percent, the biggest increase in more than a year.

Fixed-asset investment in urban areas increased 26.6 percent in the first seven months from a year earlier, close to the 26.7 expansion in the first half.

The Consumer Price Index, a barometer of inflation, jumped by a 10-year-high 5.6 percent in July, well above the official target of 3.0 percent.

The inflation rate is also higher than the deposit rate, indicating a loss of purchasing power if people put their money into banks.

The low interest rate policy has somewhat encouraged an exodus of bank savings to the country's skyrocketing stock market, which has soared more than 80 percent so far this year on top of a 130 percent rally in 2006.

(source: chinadaily.com.cn)

Individuals Allowed to Buy Overseas Shares

Mainland residents will, for the first time, be allowed to directly invest in overseas securities under a pilot program to be launched in the northern port city of Tianjin.

Investors can use their foreign exchange or purchase foreign currency to open an account with Bank of China's Tianjin branch or Bank of China International Securities in Hong Kong, according to a statement on the State Administration of Foreign Exchange (SAFE) website yesterday.

The investment amount will not be subject to the annual limit of US$50,000 for an individual to purchase foreign exchange, as per earlier rules.

"This is part of the process of China's capital account reform," Chen Jijun, analyst with Beijing-based CITIC Securities, told China Daily. "It will help ease liquidity pressure in the country as foreign exchange reserves pile up rapidly," Chen said.

Stephen Green, senior economist with Standard Chartered Bank (China), described it as "a historic move in China's capital account opening".

SAFE said in the statement: "This is an important measure to widen the channels for foreign exchange outflows and promote basic balance in international payments."

Individuals were earlier allowed to invest overseas indirectly through banks, brokerages, insurers and fund managers through the qualified domestic institutional investors (QDII) scheme.

Analysts said the Hong Kong market will be the first to benefit as many mainlanders are likely to buy stocks of mainland companies listed there.

"The policy will surely be welcomed by Hong Kong investors, because mainland investors' participation will help boost confidence as well as market sentiment," said Paul Lee, banking and insurance analyst at Hong Kong-based Taifook Securities.

Lee said the mainland will benefit too, as capital diverted from the A-share market will help "prevent over-heating" and "relieve pressure for the yuan to rise".

(Source: China Daily August 21, 2007)

Investors can use their foreign exchange or purchase foreign currency to open an account with Bank of China's Tianjin branch or Bank of China International Securities in Hong Kong, according to a statement on the State Administration of Foreign Exchange (SAFE) website yesterday.

The investment amount will not be subject to the annual limit of US$50,000 for an individual to purchase foreign exchange, as per earlier rules.

"This is part of the process of China's capital account reform," Chen Jijun, analyst with Beijing-based CITIC Securities, told China Daily. "It will help ease liquidity pressure in the country as foreign exchange reserves pile up rapidly," Chen said.

Stephen Green, senior economist with Standard Chartered Bank (China), described it as "a historic move in China's capital account opening".

SAFE said in the statement: "This is an important measure to widen the channels for foreign exchange outflows and promote basic balance in international payments."

Individuals were earlier allowed to invest overseas indirectly through banks, brokerages, insurers and fund managers through the qualified domestic institutional investors (QDII) scheme.

Analysts said the Hong Kong market will be the first to benefit as many mainlanders are likely to buy stocks of mainland companies listed there.

"The policy will surely be welcomed by Hong Kong investors, because mainland investors' participation will help boost confidence as well as market sentiment," said Paul Lee, banking and insurance analyst at Hong Kong-based Taifook Securities.

Lee said the mainland will benefit too, as capital diverted from the A-share market will help "prevent over-heating" and "relieve pressure for the yuan to rise".

(Source: China Daily August 21, 2007)

Sunday, August 19, 2007

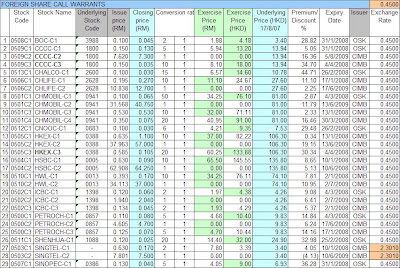

List of foreign share call warrants

These CWs with low premiums are worth looking at:

These CWs with low premiums are worth looking at:1) CCCC-C1 RM0.13, underlying share price HKD13.94, premium 5.05%

2) CHMOBIL-C1 RM0.065, underlying share price HKD81.00, premium 2.87%

3) HKEX-C1 RM1.10, underlying share price HKD106.30, premium 0.34%

4) ICBC-C3 RM0.045, underlying share price HKD4.26, premium 5.37%

Thursday, August 9, 2007

List of HK call warrants sorted by premium

Here is an updated list of Hong Kong call warrants sorted from the lowest premium to the highest. As you can see from the list, CCCC-C1 is having the lowest premium of 0.27% which is nearly at par with its underlying share's value. The lower the premium, the better (or cheaper) the CW is. CWs with longer expiry period usually have a higher premium compared to the ones which are close to expiry (This is also referred to as the time value).

Here is an updated list of Hong Kong call warrants sorted from the lowest premium to the highest. As you can see from the list, CCCC-C1 is having the lowest premium of 0.27% which is nearly at par with its underlying share's value. The lower the premium, the better (or cheaper) the CW is. CWs with longer expiry period usually have a higher premium compared to the ones which are close to expiry (This is also referred to as the time value).The orange column shows the theoretical price of the underlying share using current CW price at zero percent premium.

CCCC-C1 with the lowest premium (0.27%) only needs its underlying share price to move up by 4 cents (15.62 - 15.58) to be at par value.

On the other hand, CCCC-C3 which is having the highest premium (24.93%) would need a 3.88 HKD (19.46 - 15.58) increase on CCCC's share price.

At current market condition, a premium of 5% to 10% would be considered fair.

The average premium of all the CWs is 8.58%. This can be used as the benchmark.

Greater China Stockmarket Summary(09/08/07)

BEIJING (XFN-ASIA) - A summary of Greater China stockmarket trading Thursday:

HONG KONG

Share prices closed lower as caution re-emerged in late trade following news that French bank BNP Paribas and a US-German joint venture financial institution have been caught up in problems in the US subprime mortgage market. Stocks had advanced significantly, but trading changed course when the news about BNP hit the market, wiping out the day's gains. Some hedge funds reduced their portfolios in Hong Kong to meet possible redemption demands, while other investors locked in profit from recent gains amid fears of more volatility in the global equity markets. The Hang Seng index closed down 97.31 points or 0.43 pct at 22,439.36.

CHINA

China closed higher, driving the composite index to another record for the fifth straight trading day(tak boleh tahan man!), as investors continued to build positions in financial stocks. Steelmakers rebounded from yesterday's weakness as investors were also upbeat about the sector on prospects of industry consolidation and after Wuhan Iron and Steel reported a 171 pct rise in firsthalf net profit. The benchmark Shanghai Composite Index, which covers both A- and B-shares listed on the Shanghai Stock Exchange, closed up 90.93 points or 1.95 pct at a record 4,754.10. The Shanghai A-share Index was up 95. 61 points or 1.95 pct at 4,989.19 and the Shenzhen A-share Index was up 21.21 points or 1.53 pct at 1,411.23. China B-shares closed higher, led by machinery and property stocks following strong gains in their A-share peers. The Shanghai B-share Index was up 4.57 points or 1.45 pct at 320.41 and the Shenzhen B-share Index up 7.25 points or 0.92 pct at 792.12.

HONG KONG

Share prices closed lower as caution re-emerged in late trade following news that French bank BNP Paribas and a US-German joint venture financial institution have been caught up in problems in the US subprime mortgage market. Stocks had advanced significantly, but trading changed course when the news about BNP hit the market, wiping out the day's gains. Some hedge funds reduced their portfolios in Hong Kong to meet possible redemption demands, while other investors locked in profit from recent gains amid fears of more volatility in the global equity markets. The Hang Seng index closed down 97.31 points or 0.43 pct at 22,439.36.

CHINA

China closed higher, driving the composite index to another record for the fifth straight trading day(tak boleh tahan man!), as investors continued to build positions in financial stocks. Steelmakers rebounded from yesterday's weakness as investors were also upbeat about the sector on prospects of industry consolidation and after Wuhan Iron and Steel reported a 171 pct rise in firsthalf net profit. The benchmark Shanghai Composite Index, which covers both A- and B-shares listed on the Shanghai Stock Exchange, closed up 90.93 points or 1.95 pct at a record 4,754.10. The Shanghai A-share Index was up 95. 61 points or 1.95 pct at 4,989.19 and the Shenzhen A-share Index was up 21.21 points or 1.53 pct at 1,411.23. China B-shares closed higher, led by machinery and property stocks following strong gains in their A-share peers. The Shanghai B-share Index was up 4.57 points or 1.45 pct at 320.41 and the Shenzhen B-share Index up 7.25 points or 0.92 pct at 792.12.

Wednesday, August 8, 2007

New listing: PBBANK-CD, TENAGA-CF, CCCC-C2, CCCC-C3, HKEX-C3

With Public Bank's share price closing at RM9.70, PBBANK-CD is currently having a premium of 13.40%. Tenaga which closed at RM10.90, would give its cw TENAGA-CF a premium of 14.68%. Since the market has been quite weak lately, a possible gain of one or two cents would do good.

China Communication Construction Corporation (1800) closed at HKD15.52;

China Communication Construction Corporation (1800) closed at HKD15.52;CCCC-C2 ---> 11.08% premium.

CCCC-C3 ---> 37.85% premium.

Hong Kong Exchange (0388) closed at HKD125.40;

HKEX-C3 ---> 27.87% premium.

CCCC-C3 and HKEX-C3 are both at extremely high premiums. At the current CW prices, the underlying shares (CCCC and HKEX) should trade above HKD 21.40 and HKD160.30, respectively. Well, that's a long way to go.

Since call warrants have limited life span, it may not wise to hold them at this level.

Both CWs will be traded on the negative side tomorrow.

Time to cover some losses:

For those who have subscribed for CCCC-C3, you can dispose the C3's and swap to C1's.

At present, CCCC-C1 is only having a premium of 1.09%. And if the underlying share price was to move up 5% (+78 cents) from HKD15.52 to HKD16.30, its CW should be valued at RM0.275 (more than 24% gain).

Another CW that is worth taking a look is ICBC-C3, which is currently at 2.58% premium.

A 5% increase (+24 cents) on the underlying share price from HKD4.72 to HKD4.96 can lift the CW's price to RM0.13 (+24% gain).

China Mobil "A" rating affirmed.

China Mobile 'A' rating affirmed; outlook stable - Fitch Ratings 2007-8-8 06:26:00 p.m. HKT, XFNA

- BEIJING (XFN-ASIA) - Fitch Ratings maintained its long-term foreign currency issuer default rating on China Mobile Ltd at ""A"", with the outlook ""stable."" The ratings agency said the rating action reflects the company's ""strong operating performance and solid financial profile."" Fitch noted that China Mobile has consistently generated positive free cash flow, enabling it to maintain a net cash position with ""robust"" financial ratios. It also said China Mobile maintains a dominant market position in the country's mobile sector, despite intense competition, and that the company has registered strong subscriber growth while increasing its market share to over 65 pct. Compared to rival China Unicom, the company registers higher minutes of usage and average revenue per user. The rating also reflects the strong growth potential for China's mobile telecom sector, where penetration is still relatively low at around 38 pct, Fitch said. At the close of today's trade in Hong Kong where it is listed, China Mobile Ltd was up 3.15 hkd, or 3.671 pct, at 88.95 hkd.

- BEIJING (XFN-ASIA) - Fitch Ratings maintained its long-term foreign currency issuer default rating on China Mobile Ltd at ""A"", with the outlook ""stable."" The ratings agency said the rating action reflects the company's ""strong operating performance and solid financial profile."" Fitch noted that China Mobile has consistently generated positive free cash flow, enabling it to maintain a net cash position with ""robust"" financial ratios. It also said China Mobile maintains a dominant market position in the country's mobile sector, despite intense competition, and that the company has registered strong subscriber growth while increasing its market share to over 65 pct. Compared to rival China Unicom, the company registers higher minutes of usage and average revenue per user. The rating also reflects the strong growth potential for China's mobile telecom sector, where penetration is still relatively low at around 38 pct, Fitch said. At the close of today's trade in Hong Kong where it is listed, China Mobile Ltd was up 3.15 hkd, or 3.671 pct, at 88.95 hkd.

PetroChina A shrs Listing on October.

BEIJING (XFN-ASIA) - PetroChina Co Ltd (HK 0857) is expected to make its mainland stock market debut as early as October, the official China Daily reported. ""We have tentatively set October for the listing,"" an official of parent company China National Petroleum Corp (CNPC) was quoted as saying. The official said PetroChina's Mainland listing will raise at least 40 bln yuan. Earlier, PetroChina announced that it filed an application with mainland regulators to issue up to 4 bln A-shares through an initial public offering in Shanghai. ""The new shares will be priced on the basis of PetroChina's share price in Hong Kong. The indicative price for the initial public offering might hover around 10 yuan,""he said. PetroChina has chosen UBS Securities, the Swiss bank's joint venture with Beijing Securities, China International Capital Corp and Citic Securities to underwrite the offering, the official said. PetroChina closed THE morning at 10.76 hkd, up 0.16 hkd.

Monday, August 6, 2007

HSI chart

Wednesday, August 1, 2007

Hong Kong Stocks in US

Last sale prices (per share) of Hong Kong stocks in US on 31 July 2007 are as follows:

(Source: NYSE website www.nyse.com, NASDAQ website http://www.nasdaq.com/,

for reference only)

HK$ Equivalent

US$ (@7.80 rounded to 4 decimal )

--------- -----------------------------------

APT SATELLITE 0.23125 1.8038

ASIA SATELLITE 2.191 17.0898

BRILLIANCE CHI N/A N/A

CHALCO 2.0144 15.7123

CHINA EAST AIR N/A N/A

CHINA LIFE 4.312 33.6336

CHINA MOBILE 11.478 89.5284

CHINA SOUTH AIR 0.8448 6.5894

CHINA TELECOM 0.577 4.5006

CHINA UNICOM 1.77 13.8060

CITY TELECOM 0.258 2.0124

CNOOC 1.186 9.2508

GUANGSHEN RAIL 0.7688 5.9966

HUANENG POWER 1.1195 8.7321

HUTCH TELECOM 1.23 9.5940

PETROCHINA 1.4726 11.4863

SHANGHAI PECHEM 0.6225 4.8555

SINOPEC CORP 1.0497 8.1877

SMIC 0.1286 1.0031

TOM ONLINE 0.17725 1.3826

YANZHOU COAL 1.7816 13.8965

(Source: NYSE website www.nyse.com, NASDAQ website http://www.nasdaq.com/,

for reference only)

HK$ Equivalent

US$ (@7.80 rounded to 4 decimal )

--------- -----------------------------------

APT SATELLITE 0.23125 1.8038

ASIA SATELLITE 2.191 17.0898

BRILLIANCE CHI N/A N/A

CHALCO 2.0144 15.7123

CHINA EAST AIR N/A N/A

CHINA LIFE 4.312 33.6336

CHINA MOBILE 11.478 89.5284

CHINA SOUTH AIR 0.8448 6.5894

CHINA TELECOM 0.577 4.5006

CHINA UNICOM 1.77 13.8060

CITY TELECOM 0.258 2.0124

CNOOC 1.186 9.2508

GUANGSHEN RAIL 0.7688 5.9966

HUANENG POWER 1.1195 8.7321

HUTCH TELECOM 1.23 9.5940

PETROCHINA 1.4726 11.4863

SHANGHAI PECHEM 0.6225 4.8555

SINOPEC CORP 1.0497 8.1877

SMIC 0.1286 1.0031

TOM ONLINE 0.17725 1.3826

YANZHOU COAL 1.7816 13.8965

Subscribe to:

Comments (Atom)